Coinbase Global, Inc. (COIN)

226.93

-0.80 (-0.35%)

NASDAQ · Last Trade: Jan 21st, 5:08 PM EST

Via MarketBeat · January 21, 2026

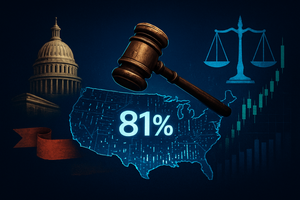

As the legal landscape for prediction markets enters its most volatile phase yet, a "Shadow Market" on the forecasting platform Manifold Markets has become the ultimate barometer for the industry's survival. Traders are currently placing an overwhelming 81% probability on a scenario where federal preemption—the legal doctrine that federal law overrides state law—will shield prediction [...]

Via PredictStreet · January 21, 2026

The rapid evolution of prediction markets has reached a fever pitch as Kalshi, the first federally regulated exchange for event contracts, officially reached "decacorn" status this month. With a fresh $11 billion valuation and weekly trading volumes consistently surpassing the $1 billion mark, the platform has transformed from a niche economic forecasting tool into a [...]

Via PredictStreet · January 21, 2026

CARACAS/NEW YORK — On January 3, 2026, at 4:21 a.m. EST, a post on Truth Social, the platform owned by Trump Media & Technology Group (NASDAQ: DJT), sent shockwaves across the globe: Venezuelan strongman Nicolás Maduro had been captured by U.S. special operations forces in "Operation Absolute Resolve." While the world grappled with the geopolitical [...]

Via PredictStreet · January 21, 2026

Speaking at Davos 2026, Coinbase (NASDAQ:COIN) CEO Brian Armstrong reiterated his view that Bitcoin

Via Benzinga · January 21, 2026

Check out the companies making headlines yesterday:

Via StockStory · January 21, 2026

Coinbase Global Inc. CEO Brian Armstrong celebrated the inaugurations of Abigail Spanberger as Governor of Virginia and Mikie Sherrill as Governor of New Jersey, framing it as a win for pro-cryptocurrency politicians

Via Benzinga · January 20, 2026

Crypto Stocks Take A Beating As Bitcoin Falls Under $90,000 Mark Amid Renewed Tariff Threatsstocktwits.com

Via Stocktwits · January 20, 2026

This fast-growing crypto exchange has big ambitions.

Via The Motley Fool · January 20, 2026

The digital asset market faced a stern reality check on January 20, 2026, as Bitcoin (BTC), the world’s premier cryptocurrency, tumbled below the critical $90,000 psychological support level. This breach triggered a synchronized sell-off across the equity markets, specifically targeting companies whose balance sheets and business models are

Via MarketMinute · January 20, 2026

Stay informed with the top movers within the S&P500 index on Tuesday.chartmill.com

Via Chartmill · January 20, 2026

Shares of blockchain infrastructure company Coinbase (NASDAQ:COIN) fell 4.4% in the afternoon session after the U.S. announced potential tariffs on several European countries.

Via StockStory · January 20, 2026

Which S&P500 stocks are moving on Tuesday?chartmill.com

Via Chartmill · January 20, 2026

What's going on in today's session: S&P500 gap up and gap down stockschartmill.com

Via Chartmill · January 20, 2026

These S&P500 stocks that are showing activity before the opening bell on Tuesday.chartmill.com

Via Chartmill · January 20, 2026

SoFi stock has underperformed the markets over the last three months. Can the Q4 earnings later this month turn the tide?

Via Barchart.com · January 20, 2026

Coinbase Global Inc. announced Monday, January 19, its support for Bermuda's ambitious plan to become the world's first "fully on-chain national economy."

Via Benzinga · January 20, 2026

Via Talk Markets · January 19, 2026

As of January 19, 2026, the financial landscape has crossed a Rubicon that many skeptics thought was decades away. The convergence of artificial intelligence and blockchain technology—commonly referred to as Decentralized AI or "DeFAI"—has birthed a new era of "Agentic Finance." In this paradigm, the primary users of the global financial system are no longer [...]

Via TokenRing AI · January 19, 2026

In a move that has sent shockwaves through the global financial landscape, Bitcoin has reclaimed the $97,000 milestone as of January 19, 2026, marking a powerful resurgence after a volatile end to the previous year. This latest surge, which saw the premier digital asset peak at $97,924 during

Via MarketMinute · January 19, 2026

The digital asset market witnessed a surge of renewed optimism this past week as Bitcoin (BTC) reclaimed the $97,000 level for the first time in months, signaling a potential end to the volatile consolidation phase that followed last year’s peak. Triggered by a "Goldilocks" inflation report and a

Via MarketMinute · January 19, 2026

As of January 19, 2026, the landscape of American finance looks fundamentally different than it did just two years ago. The once-fringe world of prediction markets has exploded into a mainstream powerhouse, driven by a radical shift in federal oversight. What began as a high-stakes legal battle between Kalshi and the Commodity Futures Trading Commission [...]

Via PredictStreet · January 19, 2026

Coinbase (NASDAQ:COIN) CEO Brian Armstrong has withdrawn support for the proposed Crypto Clarity Act, citing fundamental flaws in the legislation.

Via Benzinga · January 19, 2026

Whether it be online shopping or social media, secular forces are propelling consumer internet businesses forward. This influence cuts both ways though because they have high exposure to the ups and downs of consumer spending,

and the market seems to believe the tide is turning in the wrong direction -

over the past six months, the industry has tumbled by 1.9%. This performance is a stark contrast from the S&P 500’s 10.1% gain.

Via StockStory · January 18, 2026

Explore how these two crypto ETFs differ in cost, risk, and portfolio approach -- key factors for aligning with your investment strategy.

Via The Motley Fool · January 18, 2026