US Global GO Gold and Precious Metal Miners ETF (GOAU)

51.89

+1.87 (3.74%)

NYSE · Last Trade: Feb 21st, 7:01 PM EST

Detailed Quote

| Previous Close | 50.02 |

|---|---|

| Open | 50.86 |

| Day's Range | 49.95 - 52.05 |

| 52 Week Range | 20.80 - 56.83 |

| Volume | 40,916 |

| Market Cap | 2.21M |

| Dividend & Yield | 0.4000 (0.77%) |

| 1 Month Average Volume | 58,986 |

Chart

News & Press Releases

SAN ANTONIO, Sept. 08, 2025 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm1 with deep expertise in global markets and specialized sectors from gold mining to airlines, today announced a net loss of $334,000, or $0.03 per share, for the fiscal year ended June 30, 2025, compared to net income of $1.3 million, or $0.09 per share, during the same period a year earlier. Total operating revenues were $8.5 million, a 23% decrease from the 12 months ended June 30, 2024.

By U.S. Global Investors · Via GlobeNewswire · September 8, 2025

Silver hits multi-year high of $40.7/ounce, outperforming other precious metals in 2025. Factors include Fed rate cut, supply constraints, and political instability. Predicted to reach $43 by 2025.

Via Benzinga · September 2, 2025

Florida Governor Ron DeSantis has enacted a new law, opening the doors for transactions using gold and silver in the state. This move is seen as a nod to the original "gold standard".

Via Benzinga · May 28, 2025

SAN ANTONIO, May 08, 2025 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the "Company"), a registered investment advisory firm1 with longstanding experience in global markets and specialized sectors, today reported operating revenues of $2.1 million and a net loss of $382,000, or $0.03 per share, for the quarter ended March 31, 2025.

By U.S. Global Investors · Via GlobeNewswire · May 8, 2025

Despite the broad-based decline, a few corners of the stock market have outperformed. Here are five top-performing ETFs from different industries that were the leaders in March.

Via Talk Markets · March 29, 2025

A new ETF, PEO AlphaQuest Thematic PE ETF, debuted with a unique strategy combining public equity and derivatives for capital growth and income.

Via Benzinga · January 30, 2025

U.S. Global Investors celebrates a successful year with its JETS ETF soaring 33%, TSA screening 5% more passengers and United Airlines stock rising 135%.

Via Benzinga · January 14, 2025

I think precious metals led by silver will be the brightest spot in the coming days and weeks, even if silver bulls didn't withstand the sellers following core PCE, and didn't buy credible bond market signs of inflation making a return.

Via Talk Markets · June 2, 2024

The price action in silver is currently far stronger than gold. This typically occurs in the late stage of an intermediate trend and a June-July surge seems likely.

Via Talk Markets · May 28, 2024

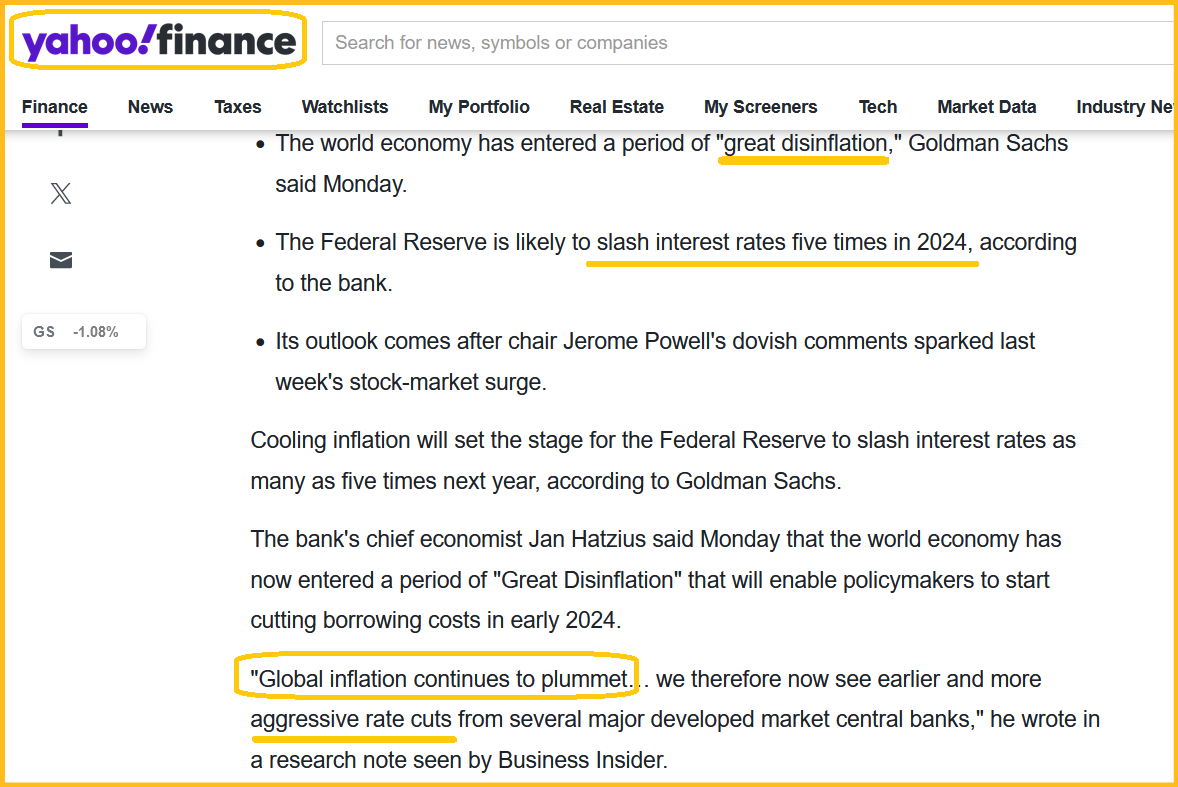

Wall Street delivered a decent performance in March with the S&P 500 adding 3.1%, the Dow Jones gaining 2.1% and the Nasdaq advancing 1.8%. Dovish Fed comments helped the stock market stay strong last month.

Via Talk Markets · April 1, 2024

The month of March has been good for the U.S. stock market, with the three major bourses on track for the fifth consecutive month of gain.

Via Talk Markets · March 28, 2024

More mainstream analysts are “tuning in” to gold by the day. They are noting the incredible resiliency of this mightiest of metals during the recent rate hiking frenzy.

Via Talk Markets · March 26, 2024

If you’re retired and need your investment portfolio to provide an income stream, you'll want to find the best monthly dividend stocks.

Via InvestorPlace · February 22, 2024

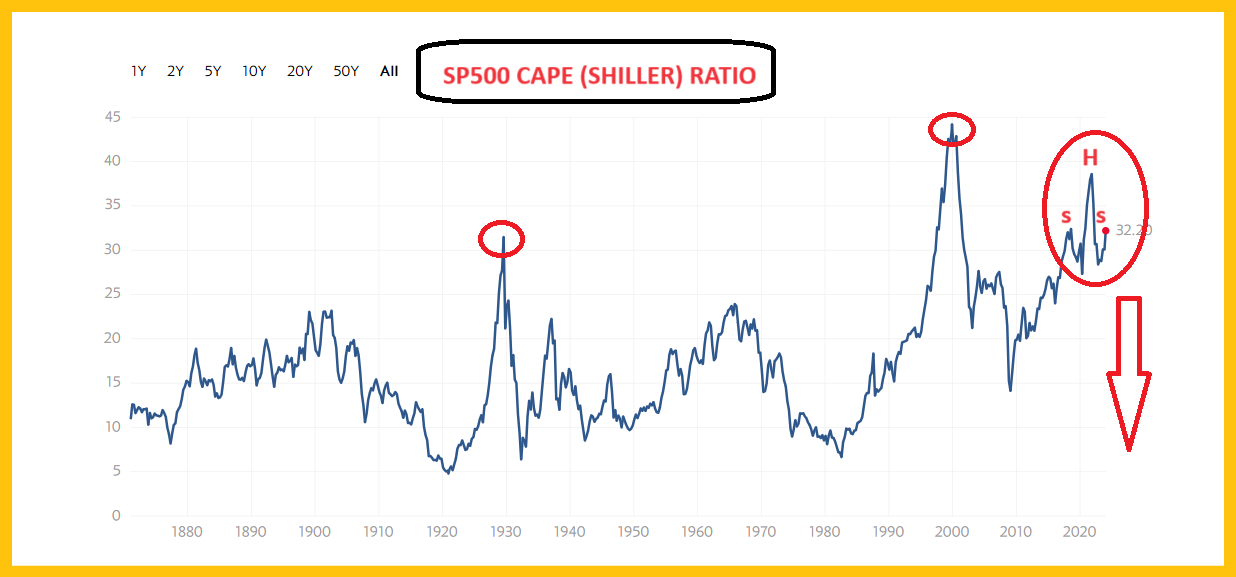

With a CAPE (inflation-adjusted P/E ratio) that Icarus would have a hard time reaching, the US stock market is ripe for a major fall.

Via Talk Markets · January 16, 2024

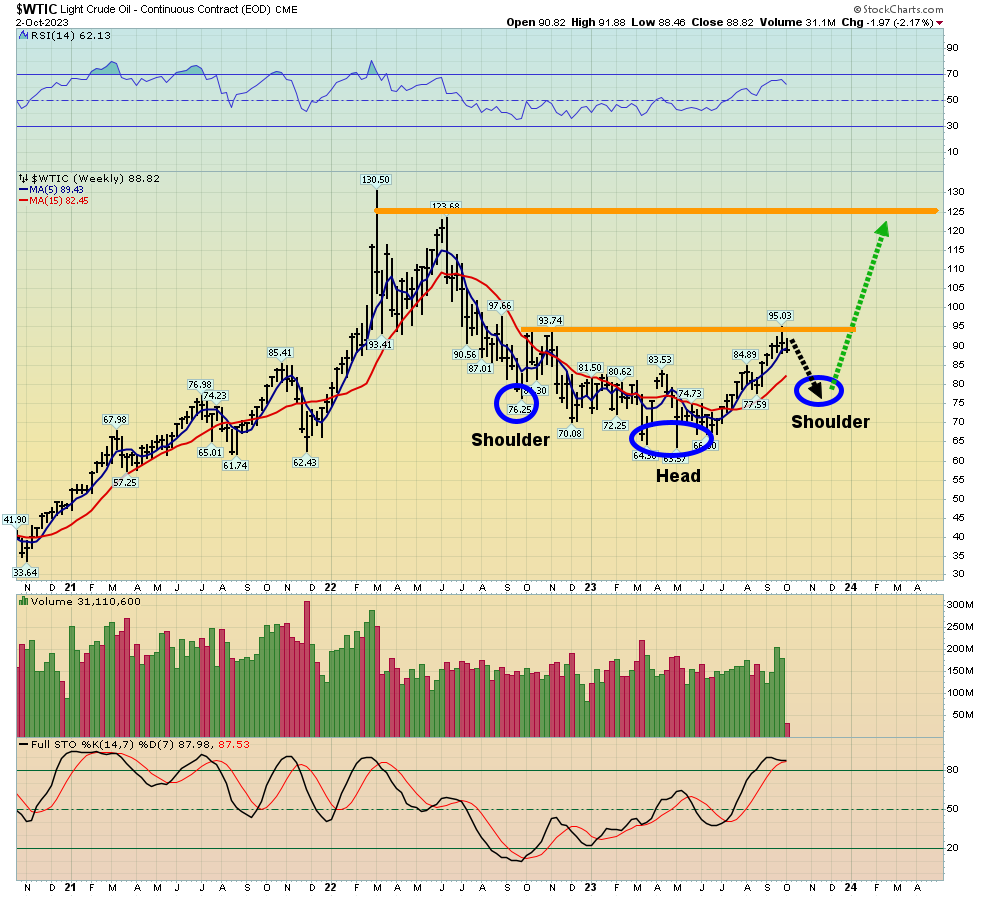

A pre-Christmas lull in trading could see a second right shoulder form, but the positive action of the Stochastics oscillator suggests that won’t happen.

Via Talk Markets · December 19, 2023

If the conflict expands further, it could likely cause global inflation and, subsequently, an acceleration in interest rates around the world.

Via Talk Markets · October 18, 2023

What’s next for gold is likely determined by how the Israeli government’s ground troop invasion plays out.

Via Talk Markets · October 17, 2023

Metal miners are the biggest beneficiaries of the surge in gold price as the mining companies act as a leveraged play on the underlying metal prices and thus tend to experience more gains than their bullion cousins in a rising metal market.

Via Talk Markets · October 16, 2023

The ten-year bond rate was about 2.5% a year ago, and gold was trading at around $1820. Now, after rates have been jacked up to 4.7%, gold is still trading at $1820.

Via Talk Markets · October 3, 2023

Aggressive investors can buy now, while those who are more conservative may want to buy only if gold trades at $1920 or $1900.

Via Talk Markets · May 30, 2023

While most of the segments rallied last month, these five ETFs from different corners of the market led the way higher.

Via Talk Markets · May 2, 2023

The 2021-2025 war cycle and bank crisis headlines make it easy for investors to lose their gold market focus.

Via Talk Markets · March 28, 2023

Instead of buying put options to protect themselves against more pain, most impaled stock market investors are inventing silly reasons to stay in the market.

Via Talk Markets · March 14, 2023

For the past few days, gold has been oozing around $1860 after staging a $100/oz “price sale”. Given the size of the rally, the $100 pullback, although violent, is normal and expected.

Via Talk Markets · February 14, 2023

Most gold bugs are not too interested in crypto or the stock market, but the same “prepare for surprise” tactical approach to the gold market is the key to investor success.

Via Talk Markets · January 17, 2023